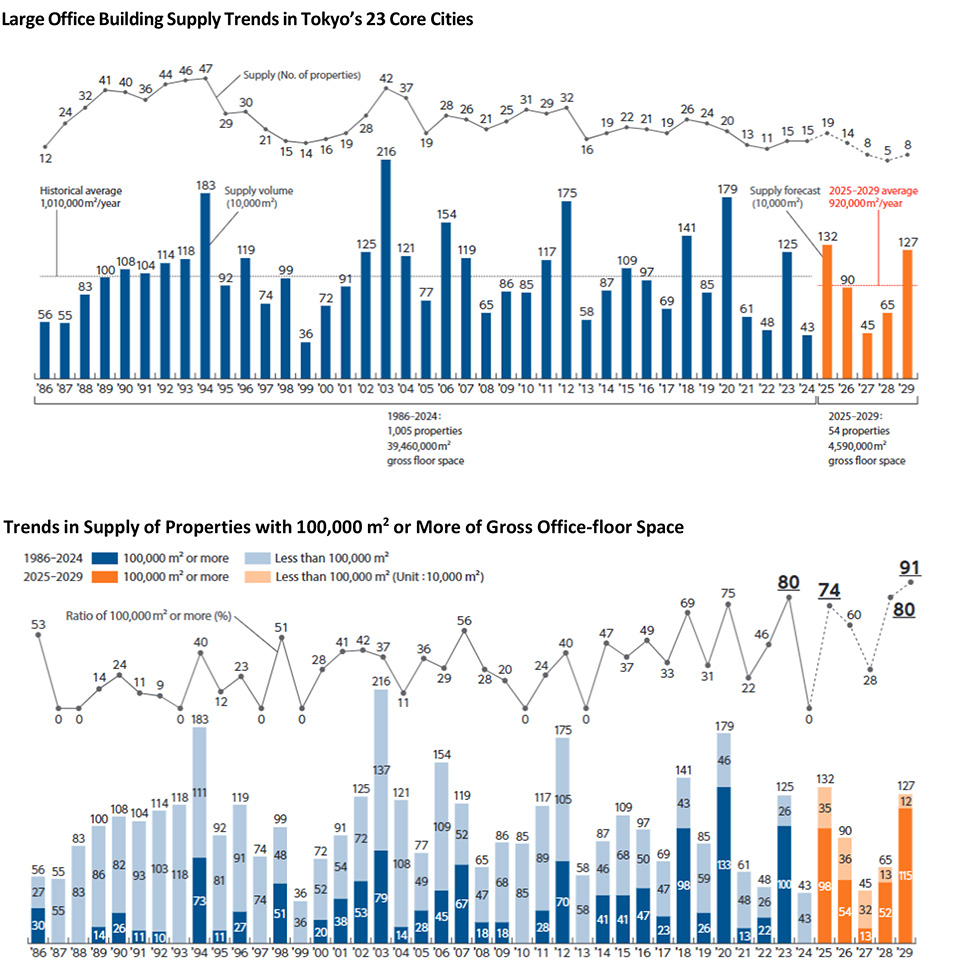

Tokyo, May 22, 2025 -- Mori Building Co., Ltd., Japan's leading urban landscape developer, released today its 2025 survey of office building supply and demand in Tokyo's 23 core cities covering calendar 2024 and forecasts for 2025 and beyond. The survey shows that in metropolitan Tokyo's 23 core cities, the supply ratio of properties with a gross office-floor area of 100,000 m² or more is 74% in 2024. In selected future years, it is forecasted to reach 80% in 2028 and 91% in 2029, indicating that office buildings will likely increase in size over the next five years. However, the average annual supply of large office buildings over the five-year period to 2029 is expected to be lower than the historical average between 1986 and 2024, suggesting that this supply volume will have only a limited impact on Tokyo's office market compared to past trends.

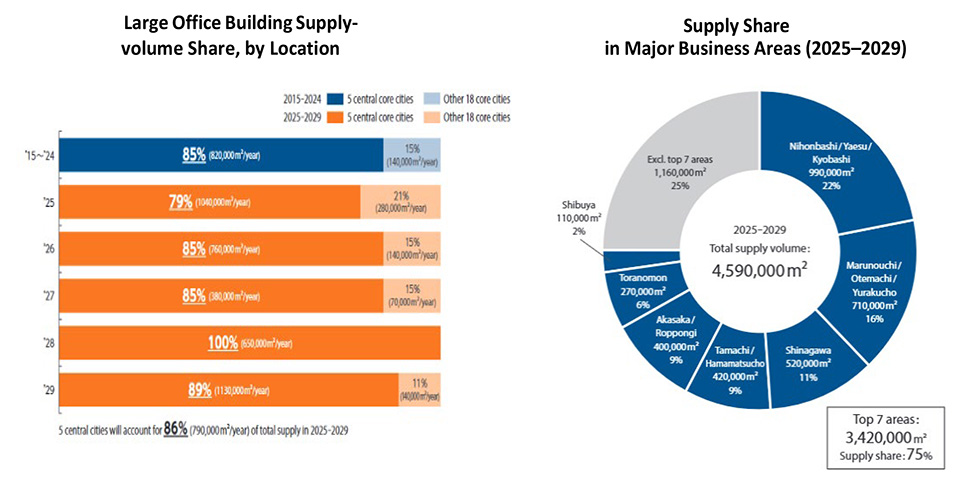

Tokyo's five most central cities--Chiyoda, Chuo, Minato, Shinjuku and Shibuya--are expected to account for 86% of the average annual supply between 2025 and 2029, close to the 85% average over the 10-year period that ended in 2024. A forecasted office supply volume of 3.42 million m² in major business areas is expected to account for 75% of total supply (4.59 million m²) in Tokyo's 23 core cities. Accelerated concentration of large office buildings is anticipated in central Tokyo, especially in the Nihonbashi/Yaesu/Kyobashi, Shinagawa, and Akasaka/Roppongi areas, where major redevelopments will contribute significantly to available supply in the five-year period to 2029.

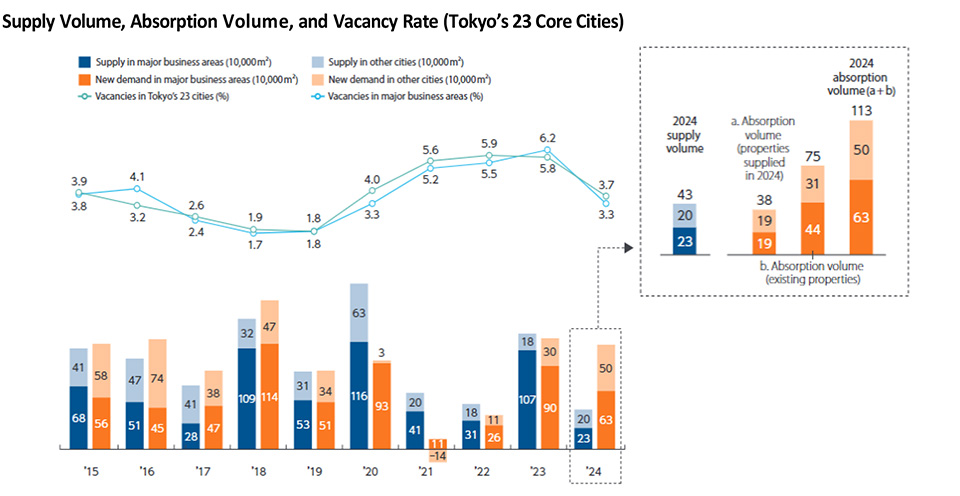

Absorption volume in Tokyo's 23 wards in 2024 reached 1.13 million m², exceeding 1 million m² for the second consecutive year. The overall vacancy rate declined significantly to 3.7%, down 2.1 percentage points from the end of 2023, and in major business areas it fell 2.9 points to 3.3%. Corporate demand for improved locations, higher-grade buildings, and innovative office environments remained strong. Unless there is a major economic slowdown, office demand is expected to remain robust and vacancy rates are likely to continue trending downward.

In a separate survey of office demand in Tokyo's 23 core cities released in December 2024, 58% of respondent companies expressed the intention to lease more office space. Those expecting to sign new leases reported pursuing favorable locations, establishing new departments, and expanding business operations and headcount. Amid a growing number of companies considering investing in office space, the demand for more space remained strong. Many companies also emphasized the important role of headquarters in strengthening internal communication and collaboration, improving employee engagement, and serving as a command center in times of emergency. Demand for properties offering hard and soft features supporting corporate growth is expected to grow.

Since 1986, Mori Building has conducted its annual survey of supply and demand trends for large office buildings (total office-floor area of 10,000 m² or more) that were fully constructed in Tokyo's 23 core cities by 1986 or later.