Tokyo, December 5, 2024 -- Mori Building Co., Ltd., Japan's leading urban landscape developer, announced today the results of its 2024 Survey of Office Needs in Tokyo's Core 23 Cities, which the company has conducted annually since 2003 to better understand trends in the Tokyo market for office buildings. The survey, which monitors new demand for office space, is sent to companies headquartered in Tokyo's core 23 cities that are ranked among the top 10,000 companies globally in terms of paid-in capital.

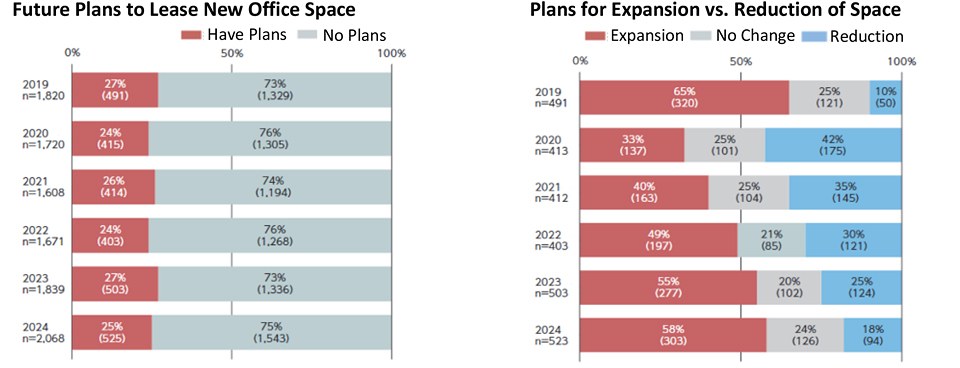

In the latest survey, conducted in September and October this year, one in four of the companies responded that they plan to lease new space, which is consistent with the trend of recent years. Of those, 58% stated they have plans to expand their leased space, the fourth consecutive year of increase.

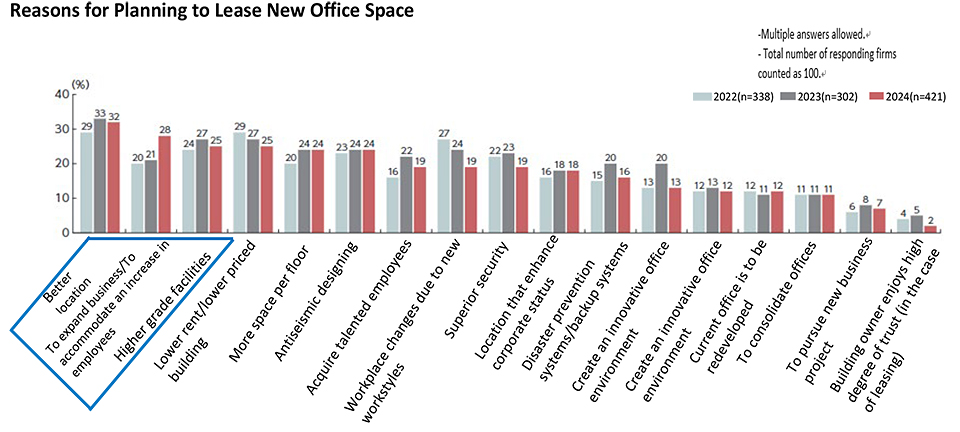

The most commonly quoted reasons for seeking to lease new space was "Better location" followed by "Expansion of business/accommodation of more employees." Meanwhile, less expensive office accommodation, one of the two most popular responses in the 2022 survey, was only the fourth-most common reason quoted this year. Additionally, the number of companies saying they needed to make changes to their workplace environment to accommodate new working styles continued to decline.

As the economic downturn following the pandemic shows signs of easing, and the trend of office relocations to accommodate diverse work styles stabilizes, more companies are considering new leases to secure a better location and higher building quality, in search of future growth.

In terms of the most desirable office locations, many companies said they prefer areas that have undergone large-scale redevelopment, such as Nihombashi (19% of respondents), Marunouchi (16%), Otemachi (15%), Toranomon(13%) and Shimbashi (12%), based on the average of all responses over the last three surveys. This reflects the high expectations for benefits from transportation convenience due to the construction of new stations, roads and other infrastructure, as well as highly functional mixed-use developments that bring work, living and recreation close together.

On average, 78% of employees were regularly commuting to work at the time of the latest survey. The proportion of companies reporting that more than 80% of their workforce were in the office every day increased to 64%, a 5-point increase over the previous survey, indicating that the resumption of office-based work is continuing.

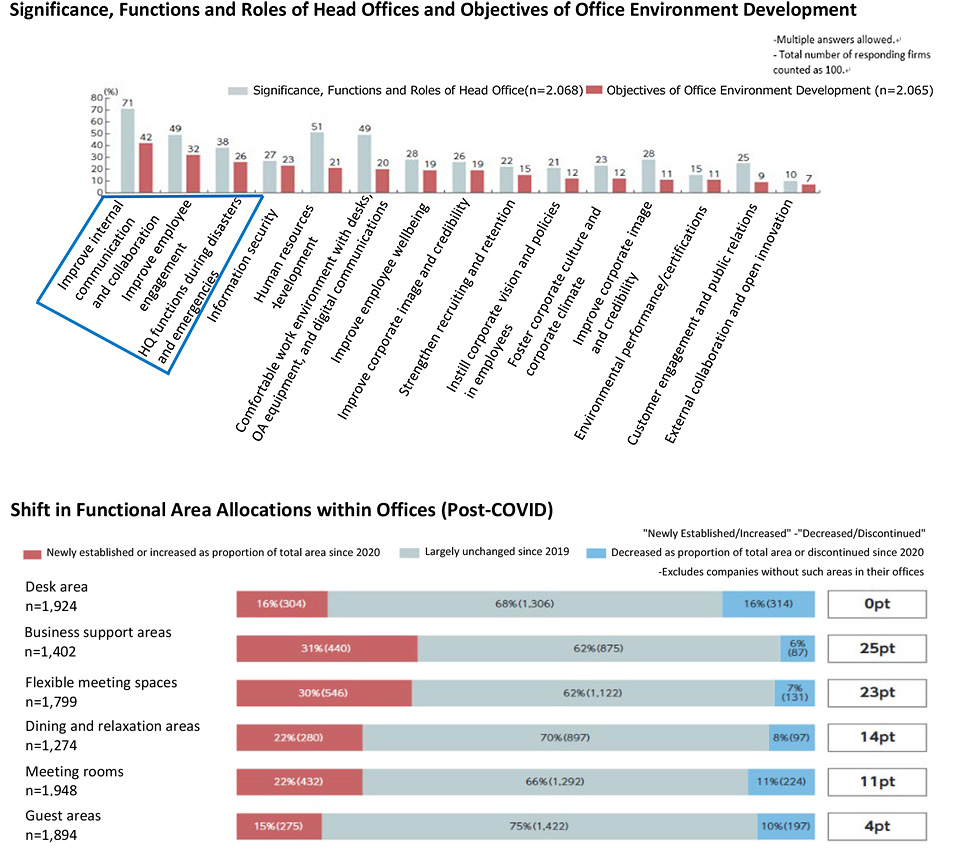

Against this background, in response to questions asking about "Significance, functions and roles of head offices" and "Objectives of office environment development," 71% of companies cited "Improved internal communication and collaboration" as a core purpose of HQs, and 42% of respondents cited this as the main consideration when planning office environments. "Improved employee engagement" was quoted as core HQ objective by 49% of respondents, and 32% said it was a main focus of office design and layout. "HQ functions during disasters and emergencies" was stated to be a core HQ focus by 38%, while 26% of respondents saw this as a key issue in office environment considerations.

86% of companies with 300 or more employees cited "Improved internal communication and collaboration" as a key role of head offices, while 58% stated this was a core objective when configuring their office environment. The corresponding percentages for those citing "Improved employee engagement" were 69% and 47% respectively; for "HQ functions during disasters and emergencies" the corresponding percentages were 50% and 28%, while 41% stated that "Improved employee wellbeing" should be a core HQ focus, and 26% indicated it was a main driver of their office environment considerations. Overall, these responses reflect considerable recognition of the impact of office environments on employees and on the importance of business continuity planning functions as an HQ focus.

Regarding changes in the proportion of office space allocated to various office functions since the end of the COVID-19 pandemic, responses indicating that business support areas, flexible meeting spaces, and dining and relaxation areas had been newly established or increased as a proportion of total office space exceeded those stating that these were being reduced in size or discontinued. This trend reflects an ongoing effort to expand office functions that enhance employee productivity, foster communication, and promote wellness. Additionally, the number of respondent companies expecting to newly establish or increase the size of such facilities continues to outnumber those anticipating reductions or discontinuations, suggesting that such expansions are likely to persist.

There is a strong indication that companies intend to lease new offices or expand their current facilities, with an increasing number of companies considering the former as a means of improving their location and building quality. This reflects the growing demand for office environments that not only serve as a workspace, but also promote internal communication, collaboration and employee engagement. To meet this need, it is expected that there will be an increasing demand for high-quality office buildings with the potential to accommodate diverse functions.