2024 Survey of Large-scale Office Buildings in Tokyo's 23 Core Cities Shows Office-supply Absorption Has Returned to Pre-pandemic Levels

Robust demand for prime business districts and high-end properties driven by increased commercial activity and expanded hiring

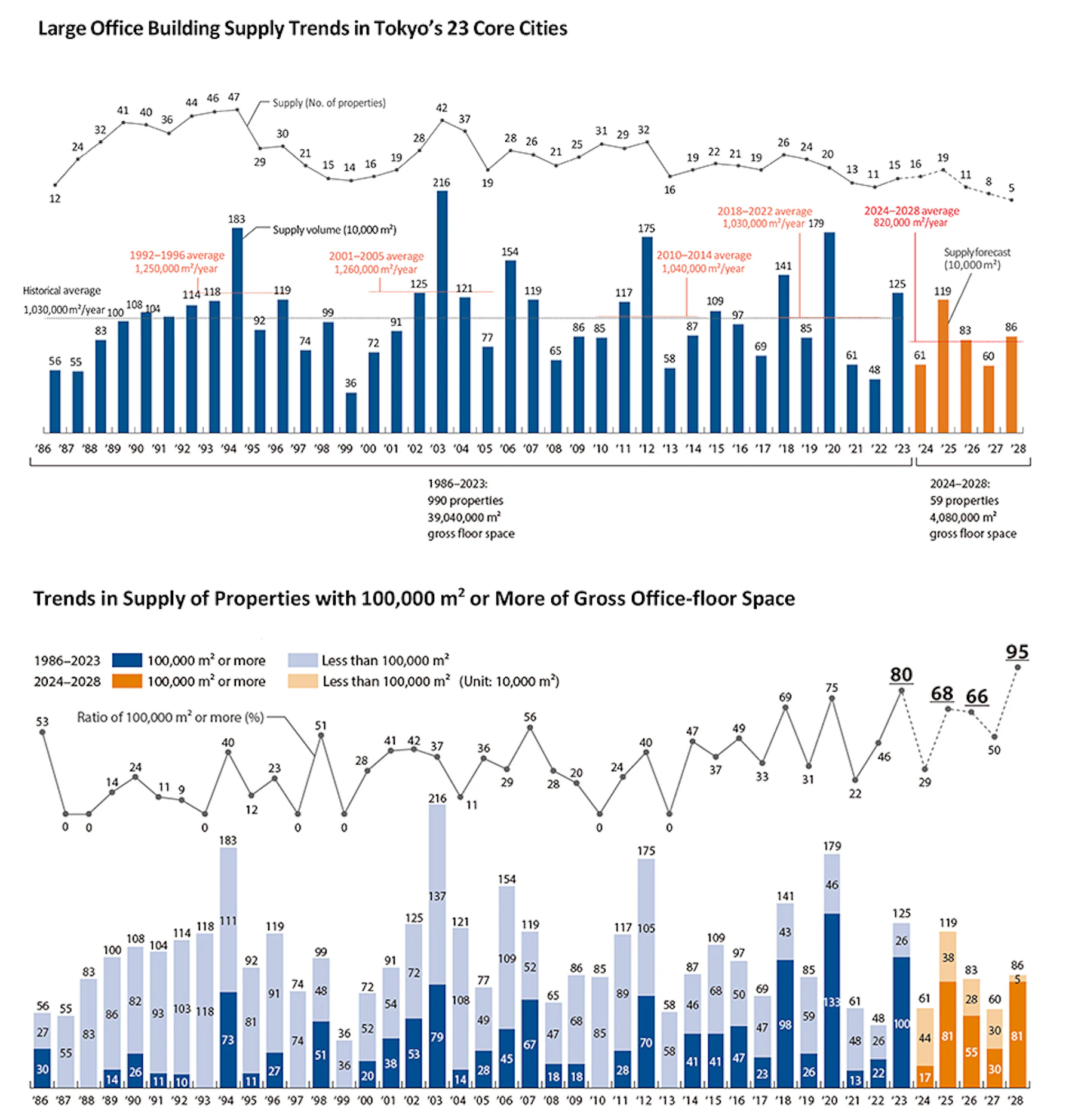

Tokyo, May 23, 2024 -- Mori Building Co., Ltd., Japan's leading urban landscape developer, released today its 2024 survey of office building supply/demand in Tokyo's 23 core cities covering calendar 2023 and beyond. The survey shows that in Tokyo's 23 core cities, the supply ratio of properties with a gross office-floor area of 100,000 m2 or more was 80% in 2023 and in selected future years is forecasted to reach 68% in 2025, 66% in 2026 and 95% in 2028, indicating that office buildings will increase in size over the next five years. However, the average annual supply of large office buildings over the five-year period to 2028 is expected to be lower than the historical average between 1986 and 2023, suggesting that this supply volume will have only a limited impact on Tokyo's office market compared to past trends.

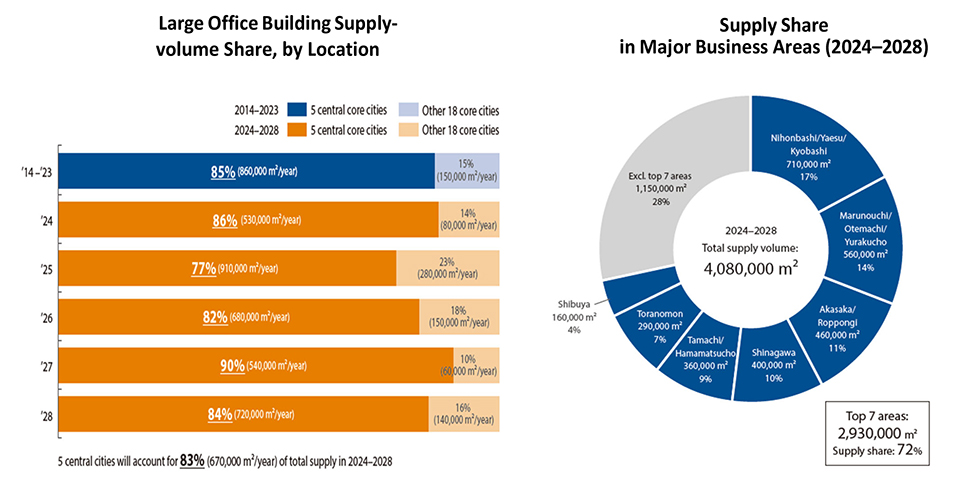

Tokyo's five most central cities--Chiyoda, Chuo, Minato, Shinjuku and Shibuya--are expected to account for 83% of the average annual supply over the five-year period to 2028, close to the 85% average over the past 10 years. Supply volume of 2.93 million m2 in the major business areas will account for 72% of total supply (4.08 million m2) in Tokyo's 23 core cities, indicating that the concentration of offices in central Tokyo will accelerate, especially in the Nihonbashi/Yaesu/Kyobashi, Akasaka/Roppongi, and Shinagawa areas, where large-scale redevelopment is underway.

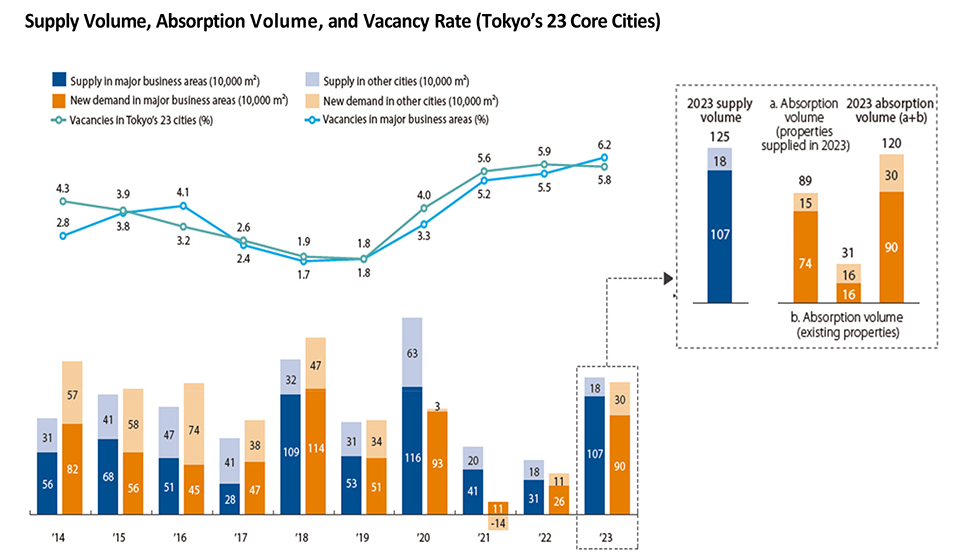

Absorption volume in Tokyo's 23 cities in 2023 was 1.2 million m2, well above the pre-pandemic (2000-2019) average of 1.06 million m2 and nearly equal to the supply volume in 2023. The vacancy rate fell to 5.8%, down 0.1 percentage point from the end of 2022, the first decline since 2019. The vacancy rate is expected to fall further in 2024 and beyond, reflecting continued strong demand for favorable locations, high-grade buildings and office environments that support innovation.

In a separate survey of office demand in Tokyo's 23 core cities released last December, the majority (55%) of respondent companies expressed the intention to lease more office space. Demand continues to recover in the post-pandemic era as more workers return to the office and high-performing and growing companies expand their business scale and hiring. Companies expecting to sign leases for more office space reported to be pursuing favorable locations, high-grade facilities, innovative office environments and talented personnel. The survey indicated that demand for office space will remain steady, particularly in major business areas where urban functions are expanding and properties are being upgraded, and will grow in the case of properties offering hard and soft features that support corporate growth.

Every year since 1986, Mori Building has surveyed office supply and demand trends for large office buildings (total office-floor area of 10,000 m2 or more) completed in 1986 or later in Tokyo's 23 core cities.

Press-related Inquiries Public Relations Department, Mori Building Co., Ltd.

TEL:03-6406-6606

FAX:03-6406-9306

E-mail:koho@mori.co.jp

Other Inquiries Strategic Planning Unit, Office Business Department, Mori Building Co., Ltd.

TEL:03-6406-6672