Mori Building Announce Results of 2023 Survey of Office Needs in Tokyo's Core 23 Cities

Plans to expand newly leased offices increase for third consecutive year Increasing emphasis on offices that promote employee communication, engagement and wellbeing

Tokyo, December 14, 2023 -- Mori Building Co., Ltd., Japan's leading urban landscape developer, announced today the results of its 2023 Survey of Office Needs in Tokyo's Core 23 Cities, which the company has conducted annually since 2003 to better understand trends in the Tokyo market for office buildings. The survey, which monitors new demand for office space, is sent to companies headquartered in Tokyo's core 23 cities that are ranked globally among the top 10,000 companies in terms of paid-in capital.

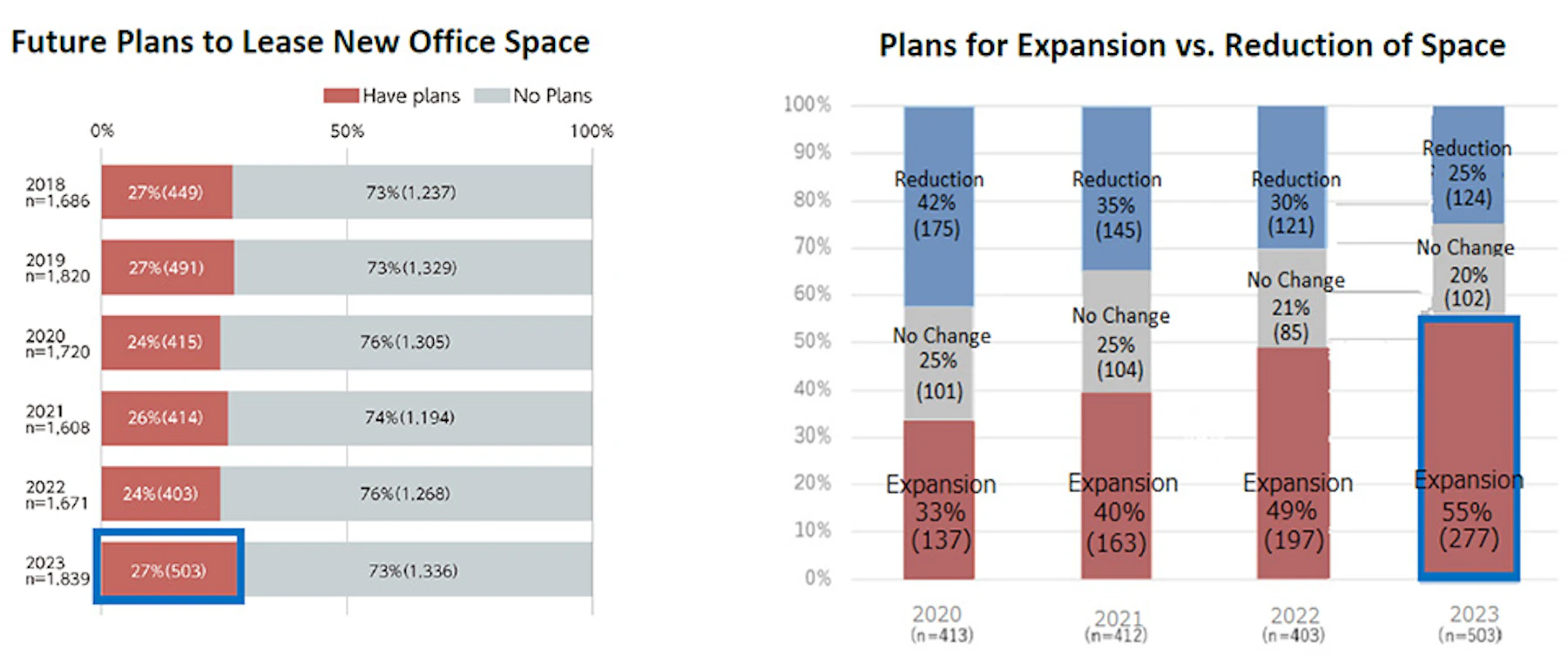

In the latest survey, conducted in September and October 2023, 27% of the companies responded that they "plan to lease new space," up three percentage points from the previous survey. Of those, 55% have "plans to expand" their leased space, up for the third consecutive year.

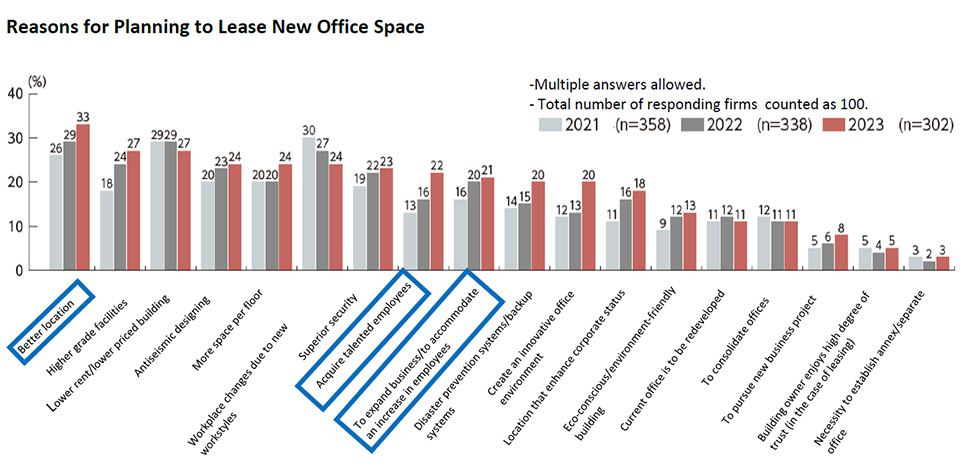

Reasons for wanting to lease new space included "Better location" and "Higher grade facilities," which were first and second, respectively, followed by " Lower rent/lower priced building," which was tied for first in the previous survey. The number of companies looking to "Acquire talented employees" or "To expand business/To accommodate an increase in employees" also rose, suggesting that more companies are planning to lease new space in anticipation of future growth.

Regarding the most desirable office locations, many companies prefer areas that have undergone major redevelopment, such as Nihombashi (19%), Marunouchi (16%), Otemachi (16%), Shimbashi (13%), and Toranomon (12%), based on the average of responses from 2021-2023 survey. Tenants in these areas expect to benefit from transportation convenience due to the construction of new stations, roads and other infrastructure, as well as highly functional mixed-use developments that bring work, living and recreation close together.

More than half of the companies view spending on their offices as an "investment" or "somewhat of an investment" rather than a "cost," which was last seen when this question was first asked in the 2014 survey. Among companies with 300 or more employees, those responding "investment" or "somewhat of an investment" rose to about 70%. The average office attendance rate at the time of the survey was 76%, and those reporting 80% or higher also increased, suggesting that companies are offering office environments that are appealing to employees.

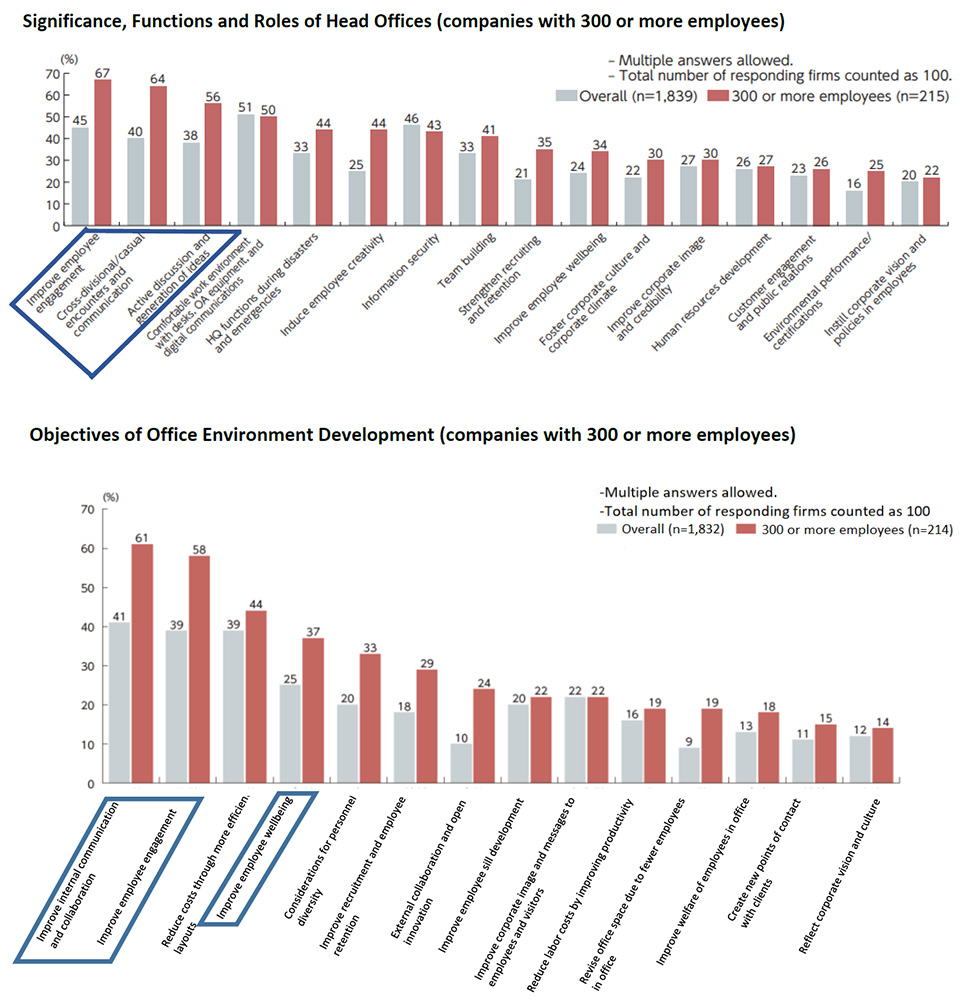

Regarding key headquarter functions and roles, the top responses were "Improve employee engagement," "Cross-divisional and casual encounters and communication" and "Active discussion and generation of ideas" among companies with 300 or more employees. Asked about the objectives of upgrading their offices, about 60% cited "Strengthening internal communication and collaboration" or "Improve employee engagement" and about 40% responded "Improve employee wellbeing."

The results show that companies above a certain size are very interested in improving their workplaces and have clear expectations about the benefits. Going forward, demand is expected to increase for offices that appeal to employees and promote communication and creativity.

Plans remain strong for both new office leasing and expansion of existing leased offices, as well as leasing in areas of Tokyo that have undergone or are undergoing major redevelopment. Also, many companies, particularly those above a certain size, see efforts to upgrade office environments as opportunities to "Strengthen internal communication" and "Improve employee engagement," which are difficult to achieve through remote work. Hard and soft solutions that address these objective are expected to be in high demand.