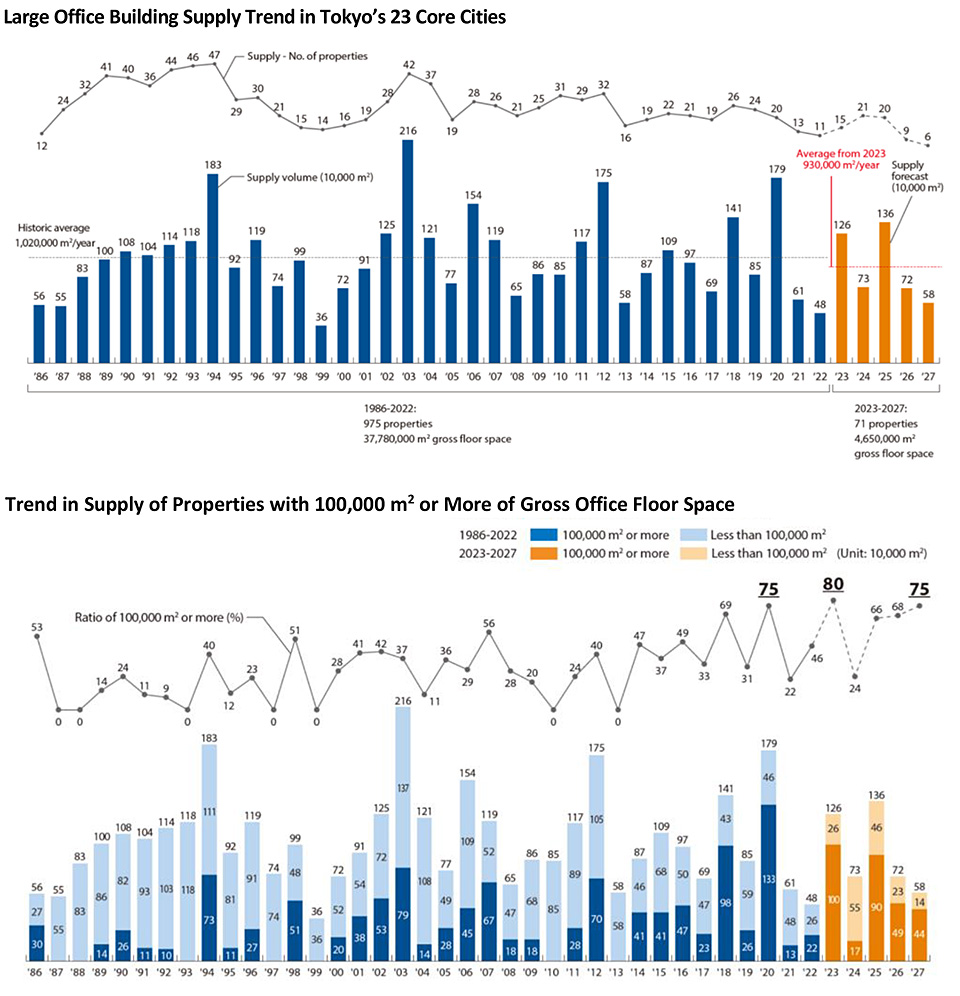

Tokyo, May 25, 2023 -- Mori Building Co., Ltd., Japan's leading urban landscape developer, released today its 2023 survey of office building supply/demand in Tokyo's 23 core cities covering calendar 2022 and beyond, which indicates that large-scale office building supply in Tokyo's 23 core cities will be somewhat favorable in 2023 and 2025, but over the five-year period to 2027 supply is expected to be lower than the historical average. The supply ratio of properties with total office-floor space of 100,000 m² or more is expected to increase to 80% in 2023 and 75% in 2027, indicating that building scale is trending upward. The annual survey, conducted since 1986, covers large-scale office buildings with gross office floor space of 10,000 m² or more.

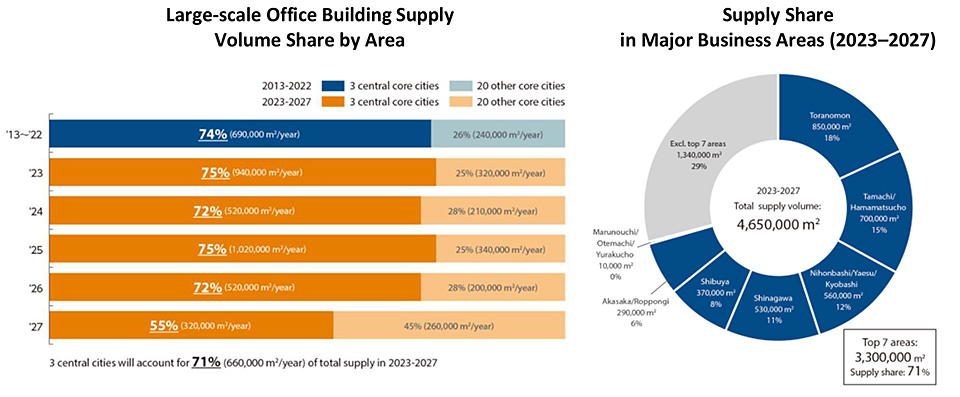

Tokyo's three most centrally located cities--Chiyoda, Chuo and Minato--are expected to account for 71% of the average annual supply over the five-year period to 2027, slightly lower than the past 10-year average (74%). Supply in the major business areas (3.3 million m²) will account for 71% of total supply (4.65 million m²) in Tokyo's 23 core cities over the same five years, indicating that the concentration of offices in central Tokyo is accelerating. Increased supply in the Toranomon, Shinagawa, and Akasaka/Roppongi areas will be particularly noteworthy.

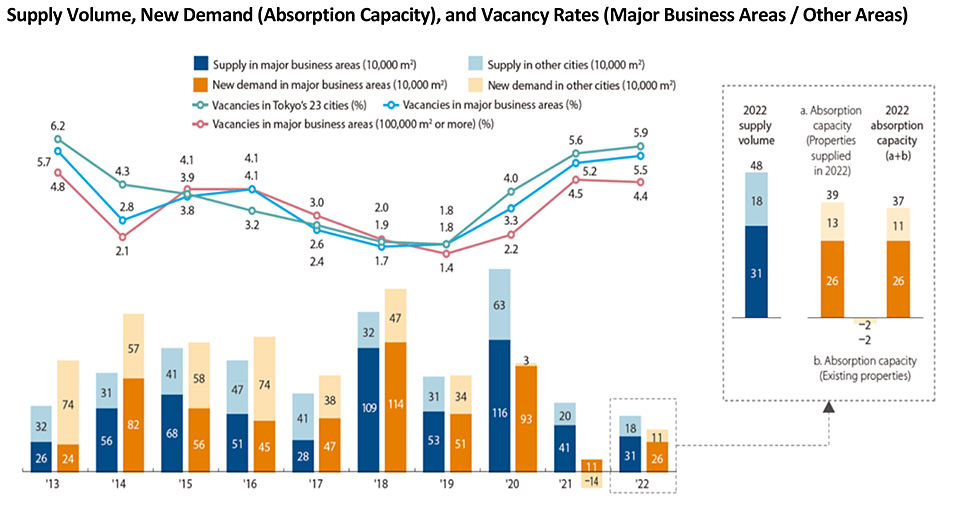

The vacancy rate in Tokyo's 23 core cities at the end of 2022 was 5.9%, up 0.3 point from the end of 2021, growing at a much slower pace than the previous year's increase. The vacancy rate in major business areas in central Tokyo was 5.5% (up 0.3 point), while the rate for properties in the same area with a total office floor space of 100,000 m² or more was 4.4% (down 0.1 point), showing a clear difference in vacancy rates by area and property grade. In terms of the absorption capacity of newly constructed properties, about 80% (390,000 m²) of the total supply (480,000 m²) was absorbed. Existing properties also showed significantly improved absorption capacity from the previous survey (-540,000 m² to -20,000 m²), indicating that office demand mainly in major business areas is recovering.

According to a separate survey of office needs in Tokyo's 23 core cities conducted last October, the number of companies planning to lease additional space continued to increase in 2022. Reasons respondents gave for their plans to lease new space included "Workplace changes due to new workstyles" and "Better location and higher-grade facilities," indicating growing needs to accommodate newly diversifying workstyles that emerged during the pandemic, as well as increased supplies of offices in major business areas offering diverse urban functions and high-end properties. Office demand is expected to accelerate in the direction of properties offering added value in both hard and soft terms.