2021 Survey of Large-scale Office Building Market in Tokyo's 23 Cities

Tokyo, May 27, 2021 -- Mori Building Co., Ltd., Japan's leading urban landscape developer, announced today its 2021 survey of office building supply/demand in Tokyo's 23 cities. The annual survey, which has been conducted since 1986, covers large-scale office buildings with gross office floor space of 10,000m² and more.

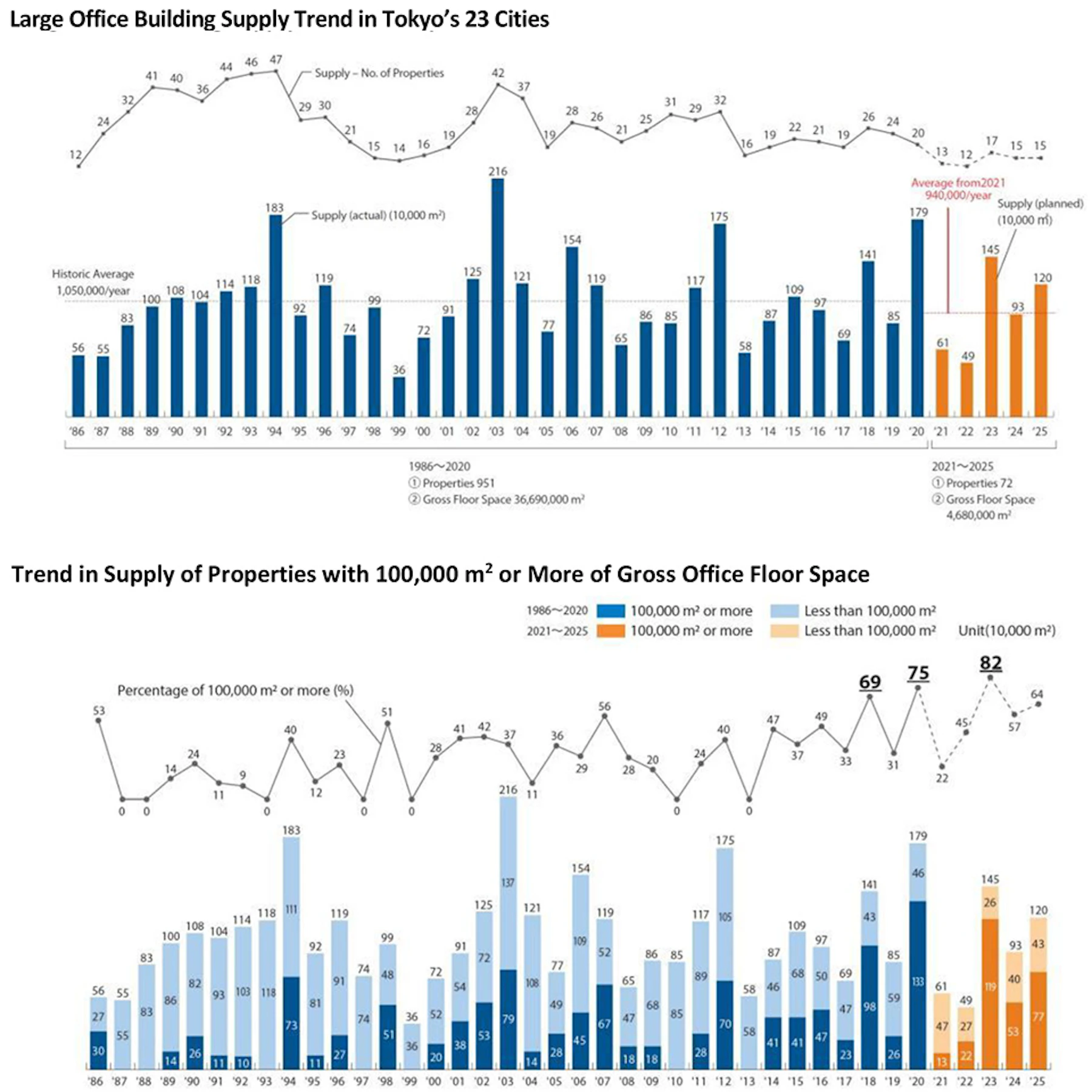

The supply of large-scale office buildings in Tokyo's 23 cities is expected to be low in 2021 and 2022, and the average supply volume over the next five years is expected to undercut the past average. Average floor space per property, however, is seen rising after reaching the survey's highest level in 2020. Office buildings are expected to grow in size, with approximately 60% of supply over the next five years forecasted to consist of properties with gross office floor space of 100,000m² and more.

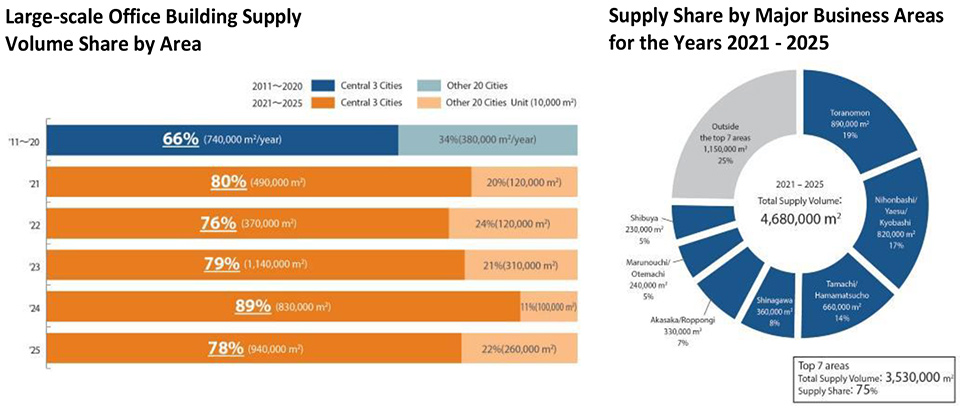

The tendency of offices to accumulate in major business areas of central Tokyo is intensifying. The three central cities are expected to account for more than 70% of the annual supply ratio over the next five years, exceeding the past decade's average of 66%. In particular, volume is expected to increase in the Toranomon, Nihonbashi-Yaesu-Kyobashi, and Shinagawa areas. The scaling up of office buildings and the concentration of offices in central Tokyo both reflect the rapid implementation of large-scale, multifunctional urban developments supported by revised regulations concerning such developments.

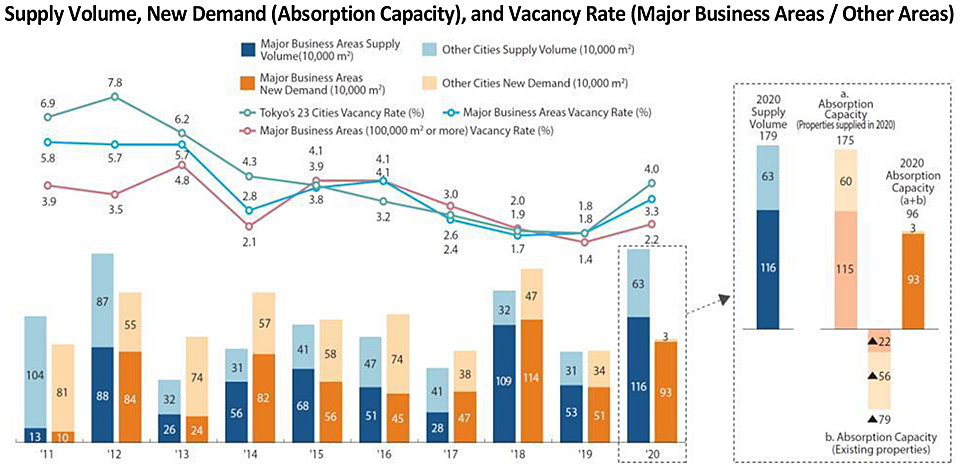

The vacancy rate overall was 4.0% at the end of 2020, increasing by 2.2 points from the previous year, but rates varied depending on the area and property grade. While vacancies in central business areas rose 1.5 points to 3.3%, vacancies for properties in the same area with 100,000m² and more gross office floor space remained low, rising only 0.8 point to 2.2%. In terms of absorption capacity in 2020, while the supply of newly built properties was almost fully absorbed, existing properties were subject to cancellations as tenants relocating to newly built properties, etc., created vacancies that required time to be reoccupied. This tendency is especially pronounced in areas other than the major business areas.

Even during the COVID-19 pandemic, demand has continued to converge on large-scale, high-grade office buildings in prime locations that offer conveniences and functionality to meet the diverse needs of companies and office workers. With the rise in remote work, demand is expected to increase for working spaces such as homes offices, satellite offices and offices that can support startups and side businesses. The diverse demand for office space is expected to sustain the office market in the future.