Mori Building Achieves Record-high Ordinary Income in Just-ended Fiscal 2019

・Ordinary income reaches record-high level due to strong sales in mainstay leasing business.

・Operating revenue, operating income and net income all exceed forecasts.

・In new fiscal year, revenue and profits both forecast to grow due to high occupancy rates and increasing unit prices in leasing business.

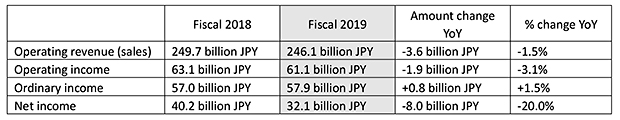

Tokyo, May 21, 2019 - Mori Building, a leading urban landscape developer, announced on May 21 its financial results for fiscal 2019,which ended in March 2019, as follows:

- The office occupancy rate reached a record high of 99%, and both offices and residences maintained high occupancy rates and high unit prices. Also, MORI Building DIGITAL ART MUSEUM: teamLab Borderless and Mori Art Museum attracted large numbers of visitors. In addition, forum business and sales at facilities, including hotels, etc., both were strong.

- In consolidated results, revenue decreased due to reduced property sales, but ordinary income reached a record high on solid performance in the mainstay leasing business.

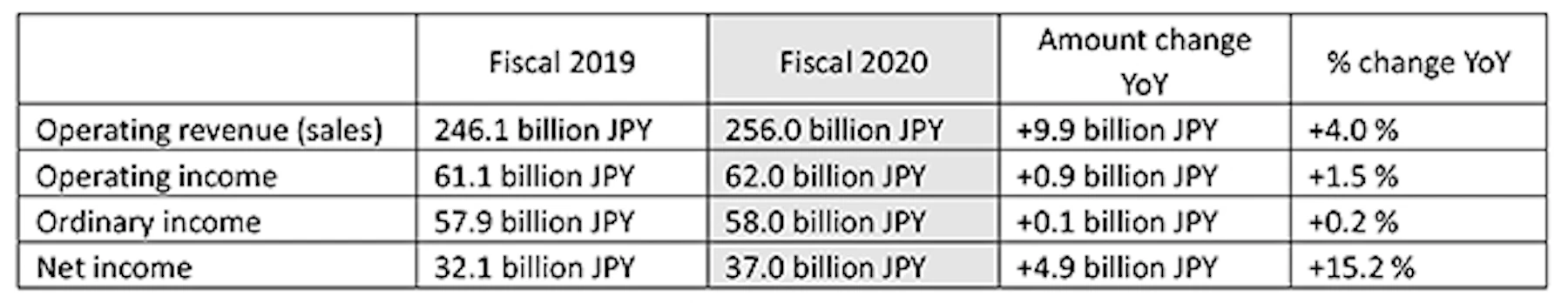

Mori Building also announced its consolidated forecasts for the current fiscal year ending in March 2020:

Consolidated results are based on information available on the day of the announcement, as analyzed by Mori Building. Forecasts are subject to inherent risks and uncertainty, so actual results may differ due to changes in various factors.