・Ordinary income reaches record-high level.

・Operating income, ordinary income and net income exceed expectations.

・Office and residential property occupancy rates and unit prices of leases remain high.

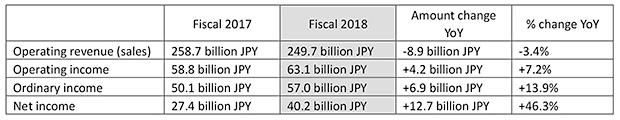

Tokyo, May 22, 2018 - Mori Building, a leading urban landscape developer, announced on May 22 its financial results for the fiscal year that ended in March 2018, as follows:

- Operating revenue fell due to a decline in property sales revenue, but operating income, ordinary income and net income all exceeded expectations.

- Major factors behind Mori Building's strong annual performance included high occupancy rates and high unit prices in office and residential leasing, rises in hotel occupancy rates and unit prices due to the growing number of inbound tourists, the opening of the GINZA SIX complex and the continued popularity of the Roppongi Hills complex, which is celebrating its 15th anniversary this year.

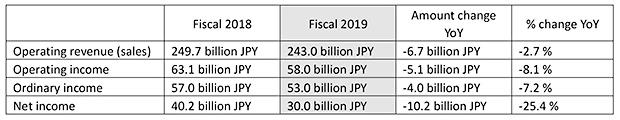

Mori Building also announced its consolidated forecasts for the current fiscal year ending in March 2019:

- Leasing business is expected to benefit from high occupancy rates and high unit prices backed by a steady market.

- Total revenue and profit are expected to decline due to decrease in residential properties scheduled to be sold and the temporary expense associated with the progress of redevelopment projects.

Consolidated results are based on information available on the day of the announcement, as analyzed by Mori Building. Forecasts are subject to inherent risks and uncertainty, so actual results may differ due to changes in various factors.