Mori Building Achieves Progress in All Segments in Fiscal Year Ending March 2017

2017/05/24Mori Building Co., Ltd.

・Office and residential property occupancy rates and unit prices of leases remain high.

・Operating and ordinary income meet expectations, excluding forex effects.

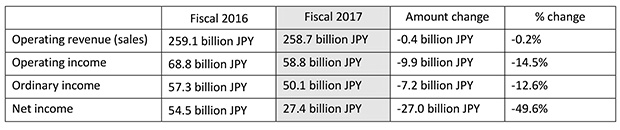

Tokyo, May 24, 2017 - Mori Building, a leading urban landscape developer, announced on May 24 its financial results for the fiscal year that ended in March 2017, as follows:

- Performance in each business segment was in line with initial forecasts, including income from entrusted projects and contracted jobs involving major redevelopment projects such as GINZA SIX and the Toranomon Hills Business Tower (tentative name), which contributed to operating revenue, as did high occupancy rates and high unit prices of leases for both offices and residences.

- Operating income and ordinary income decreased more when factoring in the effects of foreign exchange rates.

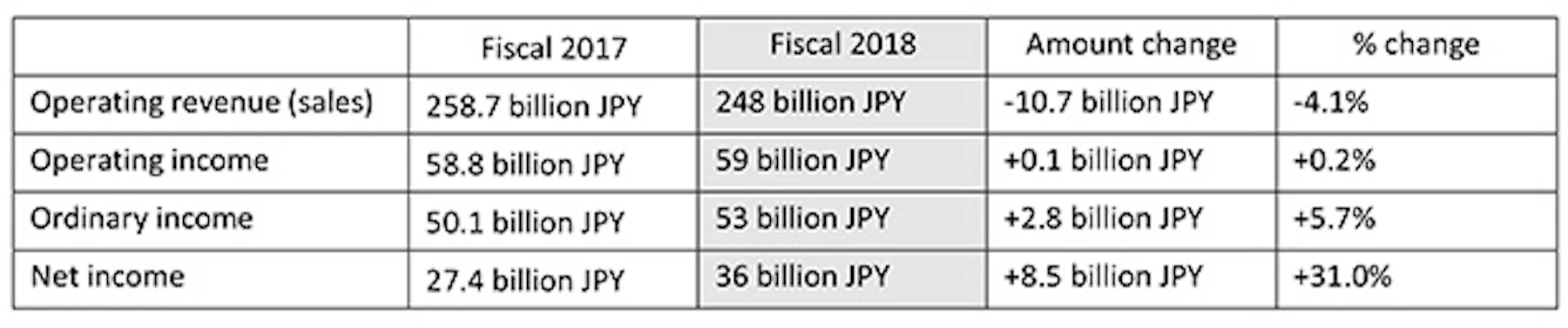

Mori Building also announced its consolidated forecasts for the fiscal year ending March 2018, as follows:

- Operating revenue is expected to decline due to fewer sales of properties.

- Operating income, ordinary income and net income are forecast to increase due to continuing high occupancy rates and high unit prices for leasing for offices and residences.

Consolidated results are based on information available on the day of the announcement, as analyzed by Mori Building. Forecasts are subject to inherent risks and uncertainty, so actual results may differ due to changes in various factors.

Related Documents

Please address inquires regarding this press release to