Mori Building Achieves Record Earnings in Fiscal Year Ending March 2015

- Operating revenue and ordinary income both set records on brisk real estate leasing and property sales

- Record operating revenue and ordinary income forecast again in FY2016 on increased leasing revenue

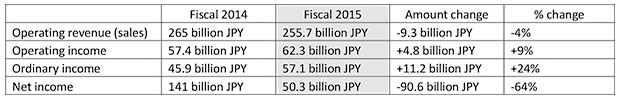

Tokyo, May 21, 2015 - Mori Building, a leading urban landscape developer, announced today its financial results for the fiscal year that ended in March 2015, as follows:

- Operating revenue of 255.7 billion JPY was down 4% as property sales recoiled from the previous year.

- Operating income of 62.3 billion JPY was up 9% due to strong property leasing and sales.

- Ordinary income rose 24% to 57.1 billion JPY, also due to strong property leasing and sales.

- Net income of current fiscal year of 50.3 billion JPY was down 64% because of the balance brought forward. Excluding this effect, real net income increased.

Below are the pertinent factors that influenced performance in various business segments.

- Leasing business declined 4% to 145.2 billion JPY due to decreased construction revenue as the Toranomon Hills project wound down, though leasing property income increased.

- Property sales of 58.7 billion JPY fell 16% following a recoil from the previous year, although Toranomon Hills residence leasing showed strong growth.

- Facilities operation business jumped 21% to 25.4 billion JPY due to the opening of Andaz Tokyo.

- Overseas business rose 3% to 31.2 billion JPY due to strong growth in leasing and favarable changes in currency rates, although property sales produced no profit.

Consolidated forecasts for fiscal year ending March 2016 are as follows:

- Operating revenue is forecast to remain steady, rising 1% to 257 billion JPY.

- Operating income is expected to rise 9% to 6.8 billion yen due to increased leasing revenue.

- Ordinary income is envisioned rising slightly by 1% to 58 billion JPY.

- Net income, a profit attributable to owners of parent, is forecast to fall 25% to 38 billion JPY due to the recoil effect caused by lowering of Japan's corporate tax rate.

Consolidated results are based on information available on the day of the announcement, as analyzed by Mori Building. Forecasts are subject to inherent risks and uncertainty, so actual results may differ due to changes in various factors.

About Mori Building

Tokyo-based Mori Building Co., Ltd. devises groundbreaking concepts for urban living throughout Asia. As one of Japan's leading developers, Mori Building creates and nurtures cities with signature "town management" solutions to help communities function and thrive. The company develops and operates multi-use facilities including high-quality offices, residences and commercial outlets, such as the Roppongi Hills and Toranomon Hills complexes in Tokyo and the Shanghai World Financial Center in China. Activities are centered on three core themes: safety and security, including disaster preparedness and security measures; the environment and greenery; and culture and art, highlighted by the Mori Art Museum. Mori Building was established in 1959.