Mori Building Co., Ltd. herein announces its financial statements for the fiscal year ended March 2010.

For more information, please refer to the attached document.

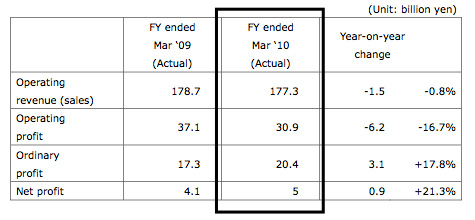

Highlights of Consolidated Financial Statements

Operating profit and net profit increased. Operating revenue (sales) declined slightly.

■Overview of Consolidated Financial Results

■Consolidated Results

- Operating revenue for the fiscal year ended March 2010 declined slightly by 1.5 billion yen (-1%) from the previous year to 177.3 billion yen.

- Operating revenue from Office Building Business decreased by 15.3 billion yen (-15%) from the previous year to 84.8 billion yen, mainly as some of the Roppongi Hills assets were taken off of the balance sheet.

- Revenue from Asset Development and Management Business increased by 5.3 billion yen (+15%) year-on-year to 41.8 billion yen, reflecting higher revenue from property sales.

- Property Management Business recorded revenue of 18.7 billion yen, up 2.0 billion yen (+12%) over the previous year, mainly due to increase in office building property management fees.

- Revenue from Facilities Operating Business fell by 2.1 billion yen (-10%) from the previous year to 18.2 billion yen due mainly to the decline in revenue from the hotel business.

- Overseas Business recorded revenue of 14.5 billion yen, up 6.0 billion yen (+70%) year-on-year, reflecting a full year operations of the Shanghai World Financial Center.

- Operating profit fell by 6.2 billion yen (-17%) from the previous year to 30.9 billion yen, mainly as some of the Roppongi Hills assets were taken off of the balance sheet.

- Ordinary profit rose 3.1 billion yen (+18%) year-on-year to 20.4 billion yen, mainly as previous year special factors such as the amortization for start-up costs in Shanghai were no longer factors in this current fiscal year.

- Net profit for the year increased for the same reason as ordinary profit, growing by 900 million yen (+21%) year-on-year to 5.0 billion yen.

(Reference)

Unrealized gains on real estate including lease properties were 554.5 billion yen on consolidated basis, and 764.4 billion yen including properties held by SPCs not subject to consolidation such as the Roppongi Hills SPC.

■Consolidated Business Forecasts for the Year Ending March 2011

- Operating revenue is expected to reach 190.0 billion yen (+7% year-on-year) as office occupancy rates increase, condominium sales and hotel operations exhibit steady growth, and as occupancy rates at the Shanghai World Financial Center improve.

- Operating profit and ordinary profit are expected to increase to 36.0 billion yen (+16% year-on-year) and 24.0 billion yen (+18% year-on-year), respectively, due to the same factors driving the growth in operating revenue.

- Net profit is expected to reach 12.0 billion yen (+140% year-on-year), mainly because of increase in ordinary profit and decrease in extraordinary loss.

< Disclaimer regarding forward-looking statements >

Business forecasts in this and the attached document are based on information available at the time these documents were released, and include a number of assumptions on various uncertain factors that could affect future business performance. Actual business results may vary considerably from the forecasts due to various factors unknown at this time.