Mori Building Announces Results of 2025 Survey of Office Needs in Tokyo’s Core 23 Cities

60% of companies planning new leases cite need for more space, up for fifth straight year Those experiencing rises in rent-cost changes up to 89%, highest in past six years

Tokyo , December 11 , 2025 — Mori Building Co., Ltd., Japan’s leading urban landscape developer, announced today the results of its 2025 Survey of Office Needs in Tokyo’s Core 23 Cities, conducted annually since 2003 to understand trends in the Tokyo market for office buildings. The survey monitors new demand for office space and is sent to companies headquartered in Tokyo’s core 23 cities that rank among the top 10,000 companies globally in terms of paid-in capital.

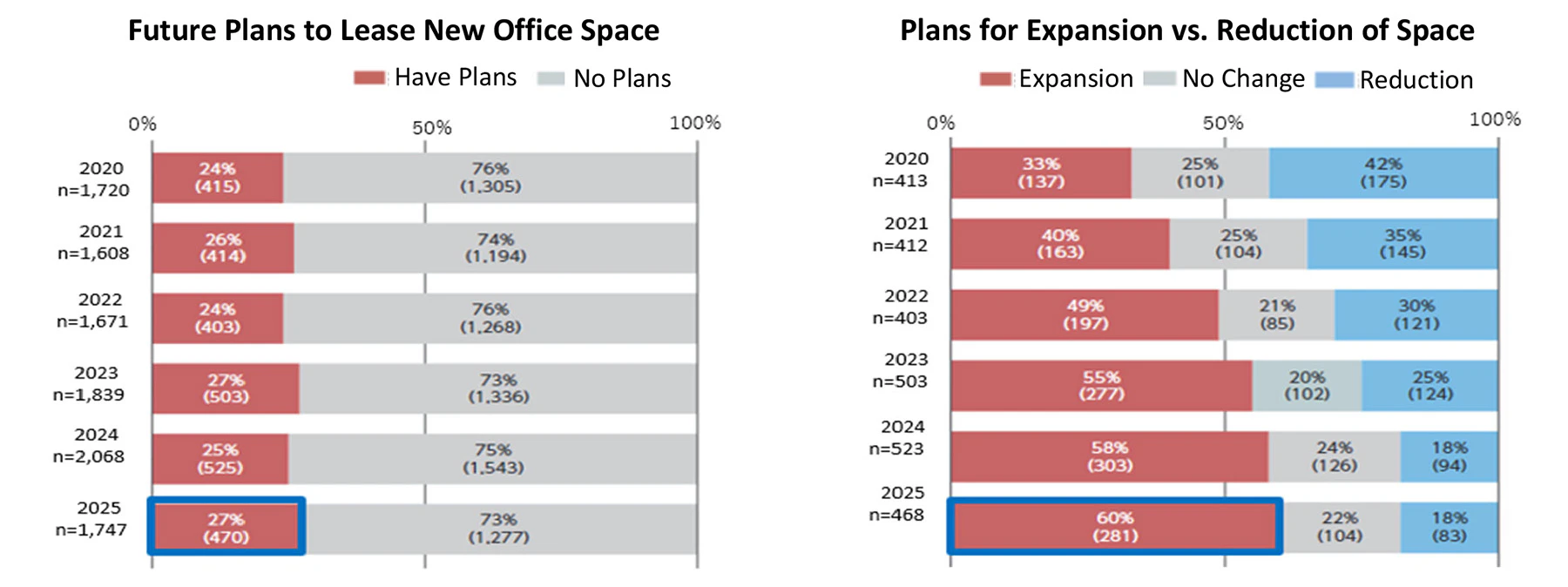

In the latest survey, conducted in September this year, companies reporting plans to lease new office space accounted for around a quarter (27%) of total respondents, similar to recent years. Among these companies, those planning to expand their leased floor space increased for the fifth consecutive year to 60%.

In the last three surveys combined (since 2023), the most common reason for planning to lease new space was “Better location,” followed by “Expand business/accommodate more employees,” and “Higher grade facilities.” Previously, reasons frequently cited during the three pandemic-era surveys (2020–2022), such as “Lower rent/lower priced building” and “Workplace changes due to new workstyles,” continued to decline.

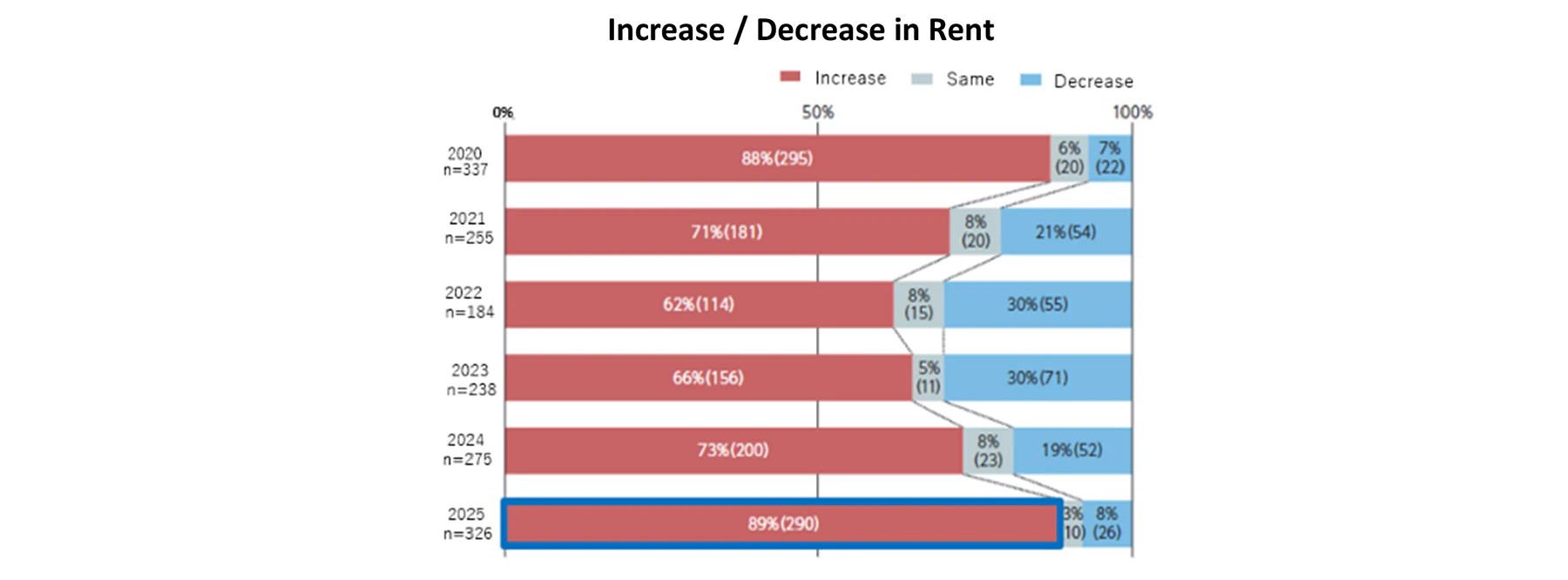

Among companies that have recently experienced a change in rent cost, those reporting an increase rose to 89%, the highest level in six years. In the coming year, around 40% said they would accept a 5-9% increase, while around 30% would accept an increase of 10% or more.

Perceptions of reasonable rent levels are also rising, reflecting renters’ growing understanding of the increasing labor and utility costs associated with building management, as well as overall inflation.

The average office attendance rate was 78%, similar to the previous survey. Companies expect the same rate of attendance in the foreseeable future, indicating that the post-pandemic return-to-office trend is stabilizing at around 80%.

Compared to the previous survey, 40% of companies reported that more employees are now working in the office, and 44% expect this number to increase further next year.

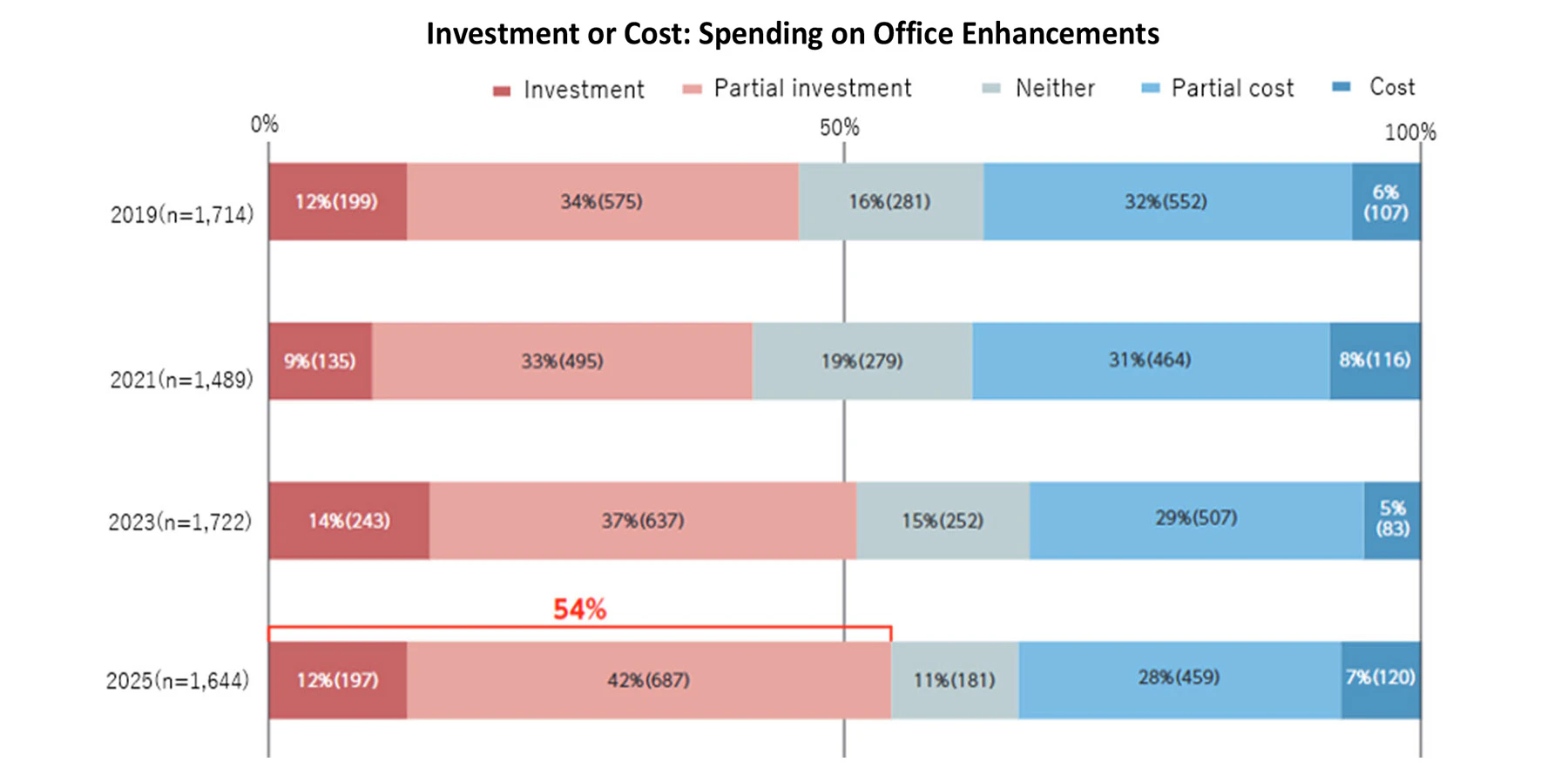

Regarding whether spending on office enhancements is considered an investment or a cost, 54% of respondents answered “investment” or “mostly an investment.” Among companies with 300+ employees, 66% gave the same answer.

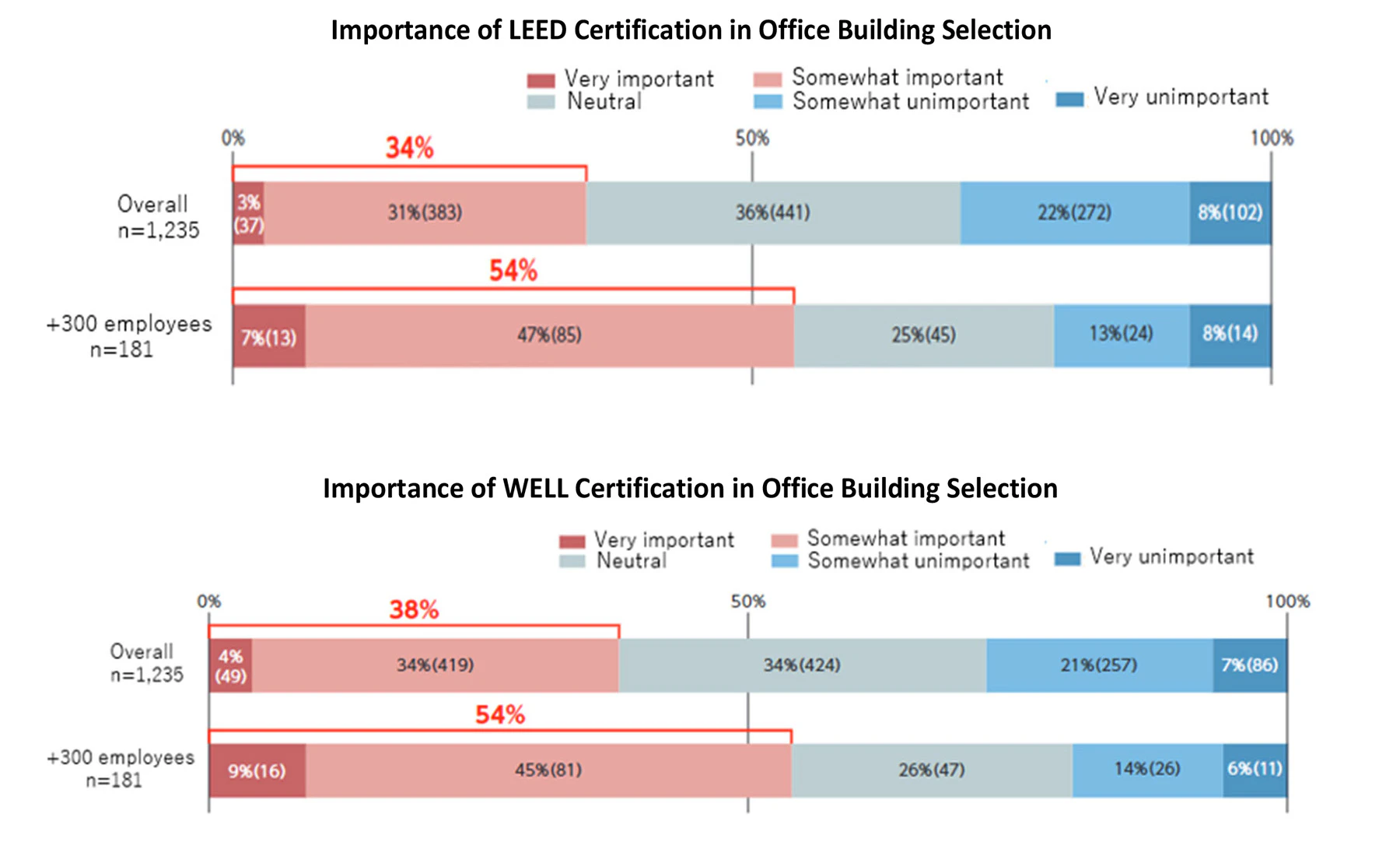

When asked about the importance of environmental and wellness certification systems, such as LEED and WELL, in selecting office buildings, around 30-40% of companies overall and over half of companies with 300+ employees responded that they “prioritize” such certifications. Among these respondents, 71% cited “To ensure comfortable and healthy office environments for employees,” indicating that companies regard comfort and employee well-being as an increasingly important considerations in office selection.

Overall, Mori Building’s 2025 survey revealed that many companies intend to lease new offices or expand their current ones. Leasing new offices is increasingly a reflection of companies pursuing improved locations and/or building quality. At the same time, more companies are viewing spending on office enhancements as an investment. Also, the level of rent that companies consider reasonable is trending upward. Taken together, these factors indicate that demand for high-quality offices in central Tokyo will remain strong and that upward pressure on rents is likely to persist.

Press-related Inquiries: Public Relations Department, Mori Building Co., Ltd.

TEL:03-6406-6606

FAX:03-6406-9306

E-mail:koho@mori.co.jp

Other Inquiries: Strategic Planning Unit, Office Business Department, Mori Building Co., Ltd.

TEL:03-6406-6300