- All-time company highs set for operating revenue, operating income, ordinary income, and net income.

- Forecasts 2nd consecutive record operating income and ordinary income for current fiscal year.

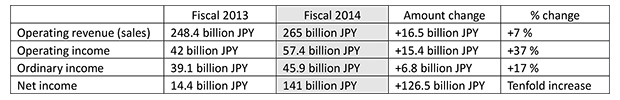

Tokyo, May 20, 2014 - Mori Building, a leading urban landscape developer, announced today its financial results for the fiscal year ending March 2014, as follows:

- Operating revenue of 265 billion JPY was up 7%, or 16.5 billion JPY, from the previous fiscal year.

- Leasing business rose 13% (17.1 billion JPY) to 151 billion JPY due to strong business and consolidation of a Roppongi Hills Financial Corp. association (name withheld).

- Property sales business declined 9% (7.1 billion JPY) to 70 billion JPY as property sales recoiled following a strong previous year, although sales of houses and lots performed well.

- Facilities operation business rose 7% (1.4 billion JPY) to 20.9 billion JPY thanks to a higher occupancy rate at the Grand Hyatt Tokyo.

- Overseas business jumped 51% (10.2 billion JPY) to 30.3 billion JPY on the strength of robust property leasing and sales of space in the Shanghai World Financial Center.

- Operating income climbed 37% (15.4 billion JPY) to 57.4 billion JPY due to healthy earnings in all segments.

- Ordinary income rose 17% (6.8 billion JPY) to 45.9 billion JPY, also due to favorable earnings in all segments.

- Net income soared tenfold (126.5 billion JPY) to 141 billion JPY mainly due to consolidation of the Roppongi Hills Financial Corp. association.

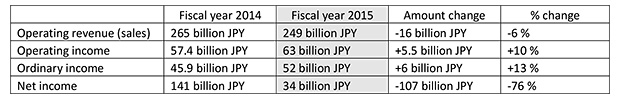

Consolidated forecasts for the current fiscal year ending March 2015 are as follows:

- Operating revenue is expected to decline 6% to 249 billion JPY.

- Operating income and ordinary income are forecast to grow 10% to 63 billion JPY and 13% to 52 billion JPY, respectively, supported by increased earnings from property sales.

- Net income is expected to fall 76% to 34 billion JPY due to a recoil following consolidation of the the Roppongi Hills Financial Corp. association in the previous year.

Consolidated results are based on information available on the day of the announcement, as analyzed by Mori Building. Forecasts are subject to inherent risks and uncertainty, so actual results may differ due to changes in various factors.